In the end, the result was very close: by a majority of one vote, the Bank of England’s Board of Trustees decided to maintain the main interest rate at 5.25 percent. Five members Monetary Policy Committee On Thursday, they voted in favor of cutting interest rates, and four voted in favor of further increases. The main reason for the break was the unexpectedly low inflation in August. At 6.7 percent, this is still higher in Great Britain than in other G-7 countries, but the trend is very clear: inflation will continue to decline in the coming months.

With the interest rate freeze, the Bank of England is now following the example of the US Federal Reserve. The central bank kept its key interest rate, known as the overnight target range, at 5.25 to 5.50 percent on Wednesday. The Swiss National Bank also left interest rates on hold on Thursday. The key interest rate in Switzerland is currently 1.75 percent, which is significantly lower than in other Western countries. However, Switzerland also recorded a relatively low inflation rate of just 1.6 percent.

Bank of England Governor Andrew Bailey can only dream about it. Before the decision, he had already said that interest rates had gradually peaked. According to the head of the central bank, the inflation rate is expected to continue to decline. On Thursday, Bailey said there was “no reason for complacency” despite the assumption. “We need to ensure that inflation returns to normal and we will continue to take the necessary decisions to get it right,” he said. However, it will take longer until the central bank’s target of two percent inflation is reached. To fight inflation, the Bank of England raised its key interest rate more than a year earlier than the European Central Bank (ECB). Now there is a gap of 5.25 percent.

However, it is uncertain whether the inflation rate will continue to decline as expected. Earlier this week, the Organization for Economic Co-operation and Development (OECD) revised its inflation forecast for the United Kingdom. According to this, prices in Great Britain will rise by an annual average of 7.2 percent – compared with 6.9 percent the OECD assumed in June. If that happens, inflation in Great Britain this year will be higher than in any other major industrial country.

For British Prime Minister Rishi Sunak, growth in inflation is important. He tied his political fate to that in January when he pledged to halve the then-current inflation rate of 5.4 percent by the end of the year. This promise was part of Sunak’s election campaign. In the United Kingdom, a new House of Commons must be elected by January 2025. However, the Prime Minister is unlikely to wait that long. An election at Westminster is expected to take place in 2024. Sunak’s Tories are currently 15 to 20 per cent behind the main opposition Labor Party in the polls.

“Communicator. Entrepreneur. Introvert. Passionate problem solver. Organizer. Social media ninja.”

More Stories

Lost the Canada engine? Verstappen and Red Bull fear phase penalty

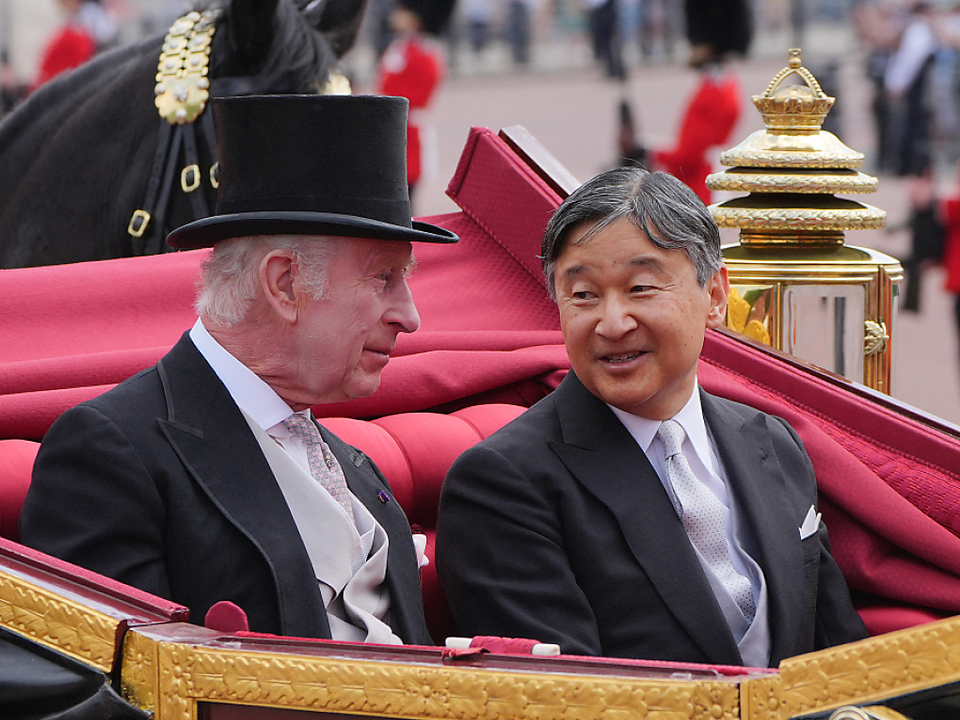

Japanese Imperial Couple Begins State Visit to Great Britain – South Tyrol News

Princess Anne has to postpone her trip to Canada